Then, take that beautiful evening walk along the beach…

Dan A. Krison, Founder

ALL DEBT FREE, LLC.

Everybody wants the same thing…

FINANCIAL CONTROL AND INDEPENDENCE.

To help you gain control over your financial affairs, and keep your crutial and almost irreplaceable Family Financial Documents and Valuables more safe and secure, All Debt Free, LLC. introduces the $trongBox–TM. This is an amazing financial tool, designed to keep your important documents and valuables safer…in a fire and water resistant Document Cabinet. Keep a copy of your Will or Trust–IRS Returns–Banking Records–Insurance–Investments–maybe even physical Gold, Silver, or Cash–whatever you have–that you may need to get your hands on–immediately.

And best of all–more safe and secure in a water and fire resistant Document Safe.

Introducing the $trongBox–TM:

Note: $trongBox–TM shown above is for illustration purposes only–we will provide digital instructions on how to create your own $trongBox–TM, and digital documents which you can use to organize it.

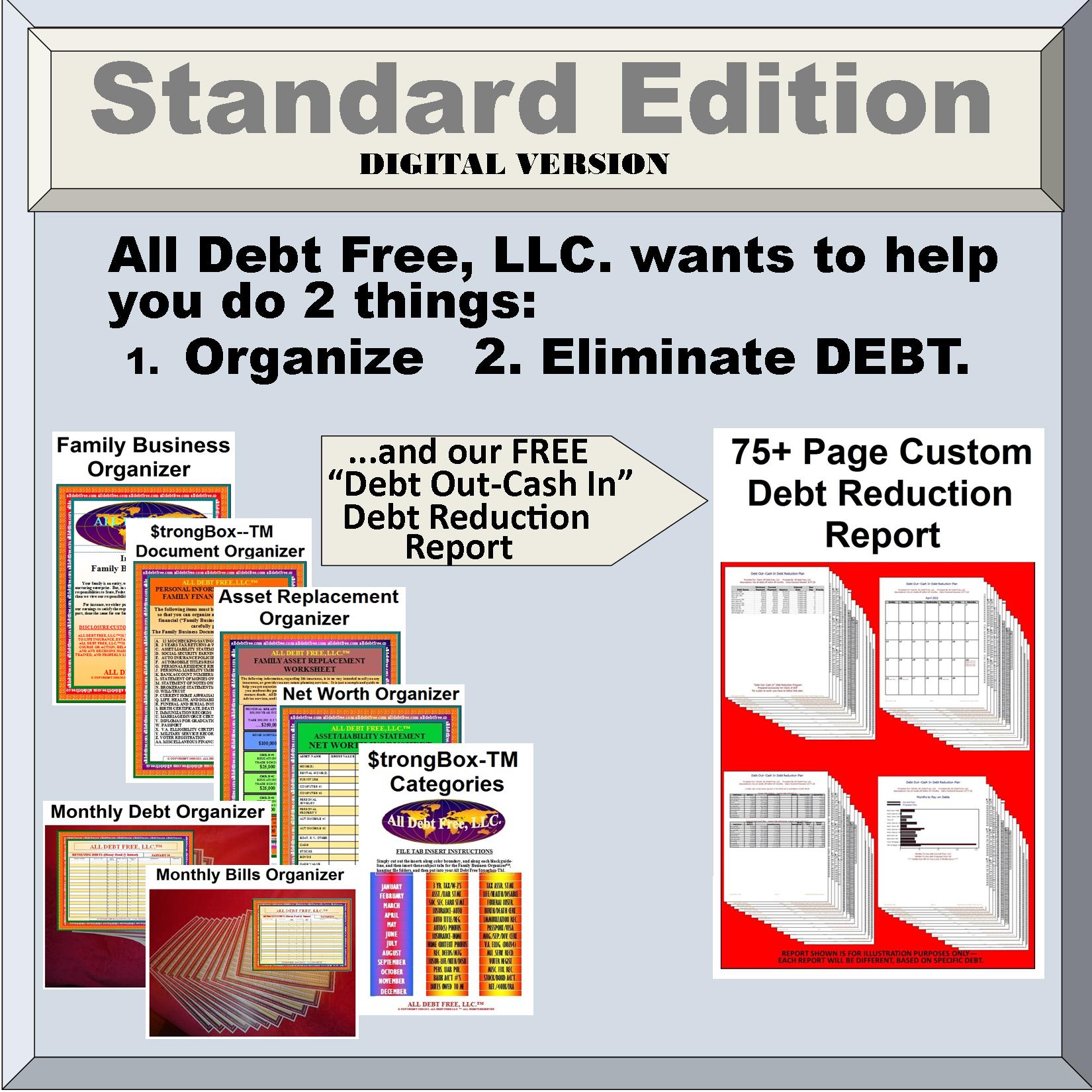

Introducing our Standard Edition–Digital Version.

Standard Edition

Digital Version

Standard (Digital) Version Includes:

Document Organizer, Family Business Organizer, Net Worth Organizer, Asset Replacement Organizer, Instructions.

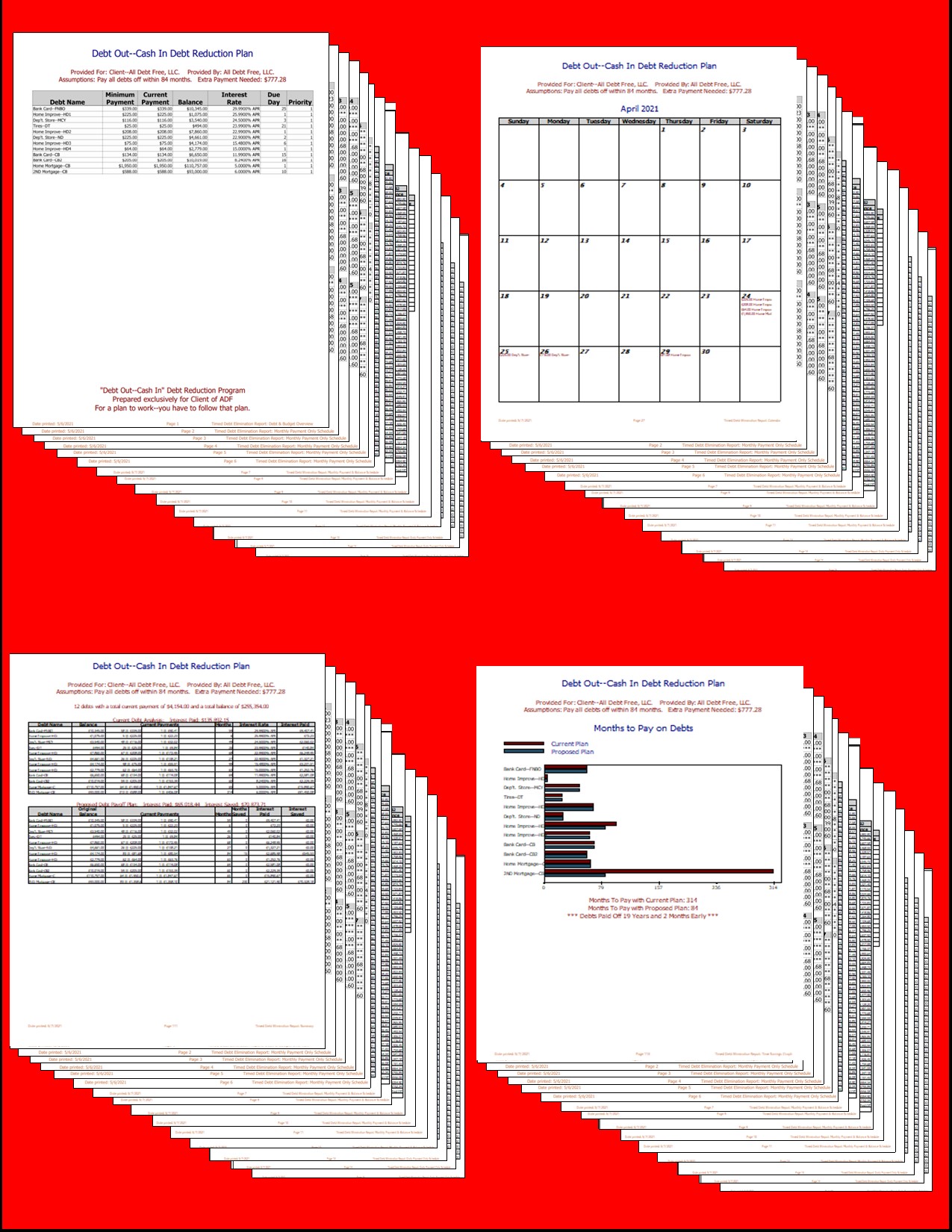

Remember, the “Debt Out–Cash In” Debt Reduction Report is FREE to you. And, if you haven’t already ordered the report, when you order our Standard Edition–Digital Version, you can “Opt-In” to get our FREE Debt Reduction report that is based on your EXACT DEBT. We provide you a quick fill document, where you fill in your basic debt information. Of course, we don’t have you give us any of your Personal Identification Information–no account numbers–not even the names of your debt. For example you would fill in the form like this:

1. “Debt 1” (not actual name), 2. Balance Amount, 3. Interest Rate, 4. Monthly Payment, 5. Monthly Due Date. We then provide you with this wonderful 70+ page digital report, which gives you options that you can choose to follow, which are designed to show you how to get your debt paid off in as few as 5 years, 7 years, or even 10 years. (We’ve seen estimated interest cost savings adding up to as much as $10,000 (and even more than that), which can occur by paying off debt much sooner than normal.

Pictured here, is our FREE “Debt Out–Cash In” Debt Reduction Plan. (If you had not already ordered our free report), when you order the Standard Edition Digital Version, you may also then “Opt In” for our FREE “Debt Out-Cash In” Debt Reduction Report. You will see a Quick-Fill Document, where you will enter in very basic data on your current debt. This allows us to prepare our Debt Reduction Report, which is customized to your particular debt, and show you optional debt payoff schedules for 5 years, 7 years, or 10 years. The “Debt-Out/Cash-In” Debt Reduction Report is approximately 75+ pages.

GET ORGANIZED. GAIN FINANCIAL CONTROL. GO ALL DEBT FREE.

Please feel welcome to send us your questions or comments:

alldebtfree.questions@gmail.com

Or, feel welcome to contact us at:

(866)500-1141

This presentation and supporting information are for educational purposes and should not be considered legal or financial advice and it is always recommended that you seek the advice of professionals. When ordering our system, you agree that we are not responsible for the success or failure of your financial decisions relating to any information presented by our company or our representatives. There is no guarantee of specific results and results may vary.